How to set up a WFOE in China?

China is one of the most attractive and complex markets in the world. Launching a business in China is an attractive but also risky challenge. This requires a perfect understanding of the country’s laws. If you are planning to set up a business in China, it is important to be aware of the various possibilities and opportunities in the Chinese economic environment.

The first question you need to ask yourself before starting the various procedures is “what type of business do I want to set up?

Foreign-owned companies may have different statuses and start-up procedures. One of the most popular types of company for foreign investors is the WFOE or Wholly Foreign Owned Enterprise.

It is a company established in China but whose owners are foreign and whose capital is brought in by foreign investors. More than 50% of foreign-invested enterprises in China are WFOEs.

Let's start with a quick reminder of what a WFOE is:

When China joined the World Trade Organisation in 2001 and the number of foreign-owned companies began to rise, the country implemented the “WFOE Laws” and “WFOE Regulations”. What are WFOEs? These are companies with limited liability. In the past, this mainly concerned production, export or advanced technology development companies.

Today, due to changes in the Chinese economic environment, companies with WFOE status are mainly those specialising in services, production, trading and Research & Development. A WFOE is financially independent and subject to Chinese law.

To be considered legal, the WFOE’s activities must fall strictly within the scope of the company’s activities. The foreign shareholders control WFOE and the Board of Directors runs it.

What are the advantages of a WFOE?

Now that you are considering the possibility of opting for a WFOE to launch your company in China, it is important that you think about its advantages and why it represents a more advantageous option than another?

- A WFOE gives the main shareholders considerable independence to develop their activities, hire employees and generate income.

- The WFOE provides a physical and legal presence in China.

- Unlike a joint venture, you won’t need a Chinese partner to run your business.

- Any profits made by the company can be converted into foreign currency and transferred abroad to the parent company, for example.

- This guarantees better protection of intellectual property because the company is independent and in control of its activities.

- You can invoice in local currency, which makes it much easier to work with local partners.

What are the limits of a WFOE?

It’s also important to be aware of the main limitations and disadvantages of a WFOE before creating one.

- The activities of a WFOE must be specifically defined by the business licence and it may not carry out any other activity outside the scope of the business. In this case, you need to opt for a fairly broad field of expertise so as not to be held back in your future projects.

- The range of investment areas is limited. A negative list has been drawn up by the Ministry of Commerce (MOFCOM) and the National Development and Reform Commission (NDRC). This list includes restricted and prohibited investment sectors.

- It’s very complicated to get a loan from Chinese banks when you have a WFOE.

If you’re convinced that the structure of a WFOE could be the right one for your future business in China, it’s time to think about the different steps you need to take.

What is the minimum amount of registered capital and total investment required to launch a WFOE?

Officially, China has eliminated the regulation concerning a minimum capital contribution to create a WFOE. However, local authorities may require a certain amount of capital to avoid problems in the future. For example, construction companies must always contribute a certain amount of capital, whereas this is not required for consultancy or service companies.

Below is an estimated ratio of total investment to registered capital:

|

Total investment |

Registered capital |

|

Less than $3 million |

70% of total investment or more |

|

Between $3 million and $4.2 million |

$2.1 million minimum |

|

Between $4.2 million and $10 million |

50% of total investment or more |

|

Between $10 million and $12.5 million |

Minimum $5 million |

|

Between $12.5 million and $30 million |

40% of total investment or more |

|

Between $30 million and $36 million |

$12 million |

|

$36 million or more |

1/3 of total investment or more |

Below is a list of the documents required to register a WFOE.

- Notice of pre-approval of company name

- Original rental contract to prove the legal address of your WFOE in China and the certificate of ownership provided by the landlord

- Foreign Invested Enterprise (FIE) application forms from the State Administration for Market Regulation (SAMR) and the Ministry of Commerce (MOFCOM)

- Shareholder resolution in the event of the establishment of an FIE, appointment of the legal representative, directors and senior executives

- Certificate of investor registration

- The WFOE association article

- Power of attorney for the provision of legal documents and for the authorisation of a person to handle the registration process

- Other documents to prove the identity of persons involved in the registration process

*Depending on your type of business or if you plan to invest in an area on the negative list, certain additional documents will be required.

We can divide the process of creating a WFOE into two parts:

- Pre-registration: steps to follow before your company officially exists in China.

- Post-registration: steps to be taken after the company has been registered.

Please note: The laws in China change very often. We try to provide you with the most up-to-date information possible.

Pre-registration procedures :

- Choosing a name for your WFOE

You need to find a name that is suitable for the Chinese market and that is approved and registered with the Chinese authorities. When it comes to choosing a company name, there are very strict laws in China.

So what can you do? Research the different requirements, what’s allowed, what isn’t and what is and isn’t available. In China, names with meaning are highly valued, and they need to reflect the services offered by their company.

In general, the name of a WFOE indicates its name, the type of industry, its location and the word “limited” at the end.

For instance : « SALVEO SHANGHAI BUSINESS SERVICE CO.,LTD » or in chinese «罗阿(上海)商务服务有限公司 ».

- Have an address for the WFOE headquarters

Depending on the nature of your WFOE: Service, Production, Trading and Research & Development, you will need to rent an official venue for your company. This could be an office or factory in the town where you have registered your business. You will need the rental contract to prove that you have a legal premises for a commercial operation. The owner will also have to provide you with official authentication documents to ensure that the property is legitimate.

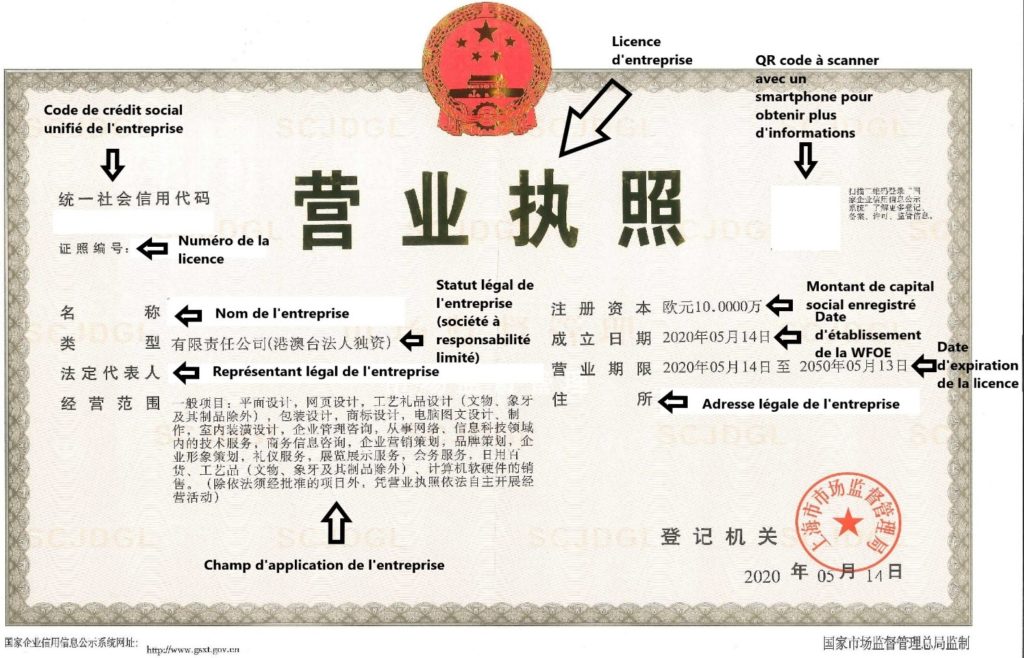

- Obtain the company’s activity licence

What is a “5 in 1” business licence?

This includes the main business licence, tax registration certificate, organisation code certificate, social security registration and statistical registration certificate.

This procedure has become much simpler over the years. However, there are two possible cases:

- The name of your WFOE has been pre-approved and you are not investing in an industry on the negative list:

The various stages will be fairly straightforward, since MOFCOM approval will no longer be required. You will only need to provide a letter of commitment from all the investors certifying that the WFOE’s investment areas are not on the negative list. You can submit your application to MOFCOM and SAMR online. Your company can be registered within a week. You will then receive your “5 in 1” business licence approximately 5 days after submitting the necessary documents to the Administration de l’Industrie et du Commerce (AIC).

If your areas of investment are on the negative list :

- Obtaining MOFCOM approval: To obtain MOFCOM approval, you must first complete an application form. Next, you will need to provide them with a letter of commitment from all investors and the WFOE name pre-approval document. All these documents must be authenticated and approved by a lawyer. Finally, you will need to provide them with the identity documents of the investors and legal representatives. These documents can be uploaded directly to an online platform, greatly speeding up the process.

- Obtain AIC approval. You will be able to apply for your “5 in 1” business licence from the AIC within 30 days of receiving approval from MOFCOM.

Congratulations! Once you have received your company licence, your WFOE will officially exist in China. You can now begin the post-registration phase

Post-registration procedures :

- Get your official seals

As soon as your company is officially established, it’s time to get your official seals. In China, a signature does not have the same legal authority as in France. This is the company’s official seal, which can be used to validate documents and contracts. You must also have the seal of the company’s official representative, a finance seal, a contract seal, an invoice seal, etc.

- Tax registration

Tax registration is a complicated procedure in China. There are two authorities: the State Taxation Bureau and the Local Taxation Bureau. Don’t worry, you will only have to register for tax purposes once, but with both authorities. This must be done within 30 days of obtaining your official business licence. Once you have provided all the documents required by the two offices, your company will be authorised to issue invoices known as “Fapiao” in China.

Depending on the status of your business – whether it is a general or small taxpayer – the amount of VAT you have to pay may change. If you are a general taxpayer, your company’s invoices can be used for tax deductions.

- Opening your WFOE’s bank accounts

In China, a WFOE must have two bank accounts: an RMB account and a foreign currency contribution account. Since your company will be operating in China, you will need an RMB account. The company can withdraw cash from this account and it is the one generally used for tax payments. As foreign capital is contributed to create a WFOE, the foreign currency contribution account is used to receive this foreign capital.

Now that you’ve followed all these steps, your WFOE is fully registered in China and can start operating!

Here is a summary of the different steps to follow:

|

Steps to create your WFOE |

|||

|

Pre-registration |

1 |

Choose a name for your WFOE |

Plan on around 10 different names |

|

2 |

Have an official address for the WFOE headquarters |

Get a rental contract |

|

|

3 |

Get your business licence: -MOFCOM approval -AIC approval |

5 to 30 days |

|

|

Post-enregistration |

4 |

Get your official seals |

3 to 5 days |

|

5 |

Tax registration |

Within 30 days of obtaining the business licence |

|

|

6 |

Open the bank accounts for your WFOE: -An RMB account -A foreign currency contribution account |

3 to 5 days |

|

Conclusion

The process of setting up a business in China is fairly long and complicated. It’s a complex business environment that requires a sound knowledge of China’s legal, political and financial systems. A large proportion of foreigners setting up a business in China choose to establish a WFOE.

The steps are clear and this allows them to retain a degree of independence and flexibility.

However, the procedures are fairly lengthy, taking between 3 and 6 months.

The Chinese authorities require a large number of documents translated into the local language and have very specific expectations. This can be confusing and even discouraging for many investors.

In this context, Salveo benefits from a wealth of experience and is available to advise and support you in the process of setting up your local legal structure.

Receive your personalized study

+33 (0)1 84 79 17 50

09h - 18h UTC+1

62 rue de Miromesnil 75008 Paris